Fallout or spillover takes different forms and the fact that the U.S. economy has been weaker than predicted or expected by those economic soothsayers came to light as Reuters noted overnight: U.S. gross domestic product increased at a 1.2 percent annual rate in the April-June period, less than a half of a 2.6 percent growth rate economists had expected.

"Investors have been shifting money to Asia, which is likely to be least affected by Brexit and as the U.S. Fed appears to be in no hurry to raise interest rates," said Yukino Yamada, senior strategist at Daiwa Securities. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 1.1 percent, hitting its highest level in about a year. Asian markets showed limited reaction to a better-than-expected private survey on China's factory sector.

The Caixin/Markit Manufacturing Purchasing Managers' index (PMI) rose to a 1 1/2-year high of 50.6, beating market expectations of 48.7 and up from 48.6 in June. An official survey showed factory activity eased in July.

The Nikkei 225 was up0.30%, turning around an earlier loss; the Korean Kospi edged higher 0.6%; the Hang Seng rallied nearly 1.4% and the Australian ASX 200 gained 0.79% while in China shares took a break with the Shanghai Composite falling 1.08% and Shenzhen Composite down almost 2%.

The Nikkei 225 was up0.30%, turning around an earlier loss; the Korean Kospi edged higher 0.6%; the Hang Seng rallied nearly 1.4% and the Australian ASX 200 gained 0.79% while in China shares took a break with the Shanghai Composite falling 1.08% and Shenzhen Composite down almost 2%.

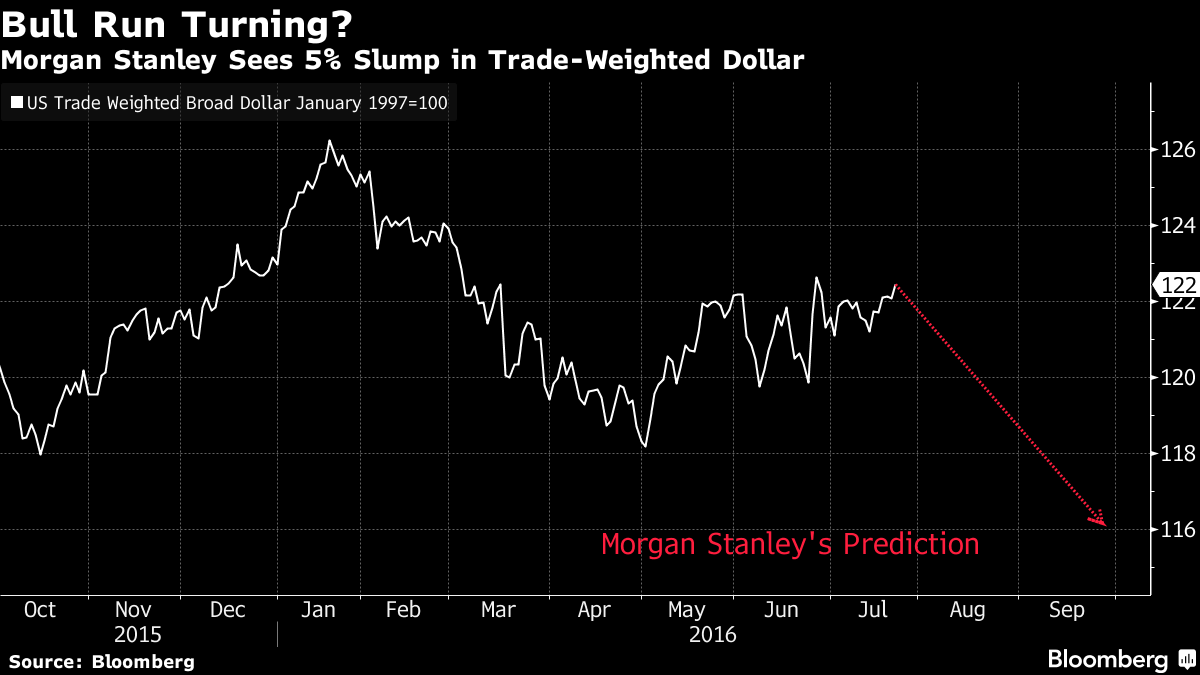

The U.S. dollar hovered near a three-week low against the yen after it's surge Friday following the BOJ's action disappointed investors who were hoping for more help. Up nearly 3% on Friday at 101.97, the yen settled lower overnight at 102.59 against the dollar. The dollar stood near a three-week low against the yen, which got a lift on Friday after the Bank of Japan's stimulus fell short of markets' expectations. Gold XAU= also hit a near three-week high of $1,355.1 per ounce on Friday and last traded at $1,351.5.

Meanwhile, NewYork Federal Reserve President William Dudley made some news, suggesting it was "premature" to count out any rate hikes this year if the economy suddenly improved. Dudley is close with Fed Chair Janet Yellen and viewed as a dove by many. He is, however, along with Yellen and one or two others the top dogs at this Fed and his barking gets attention accordingly.

Meanwhile, NewYork Federal Reserve President William Dudley made some news, suggesting it was "premature" to count out any rate hikes this year if the economy suddenly improved. Dudley is close with Fed Chair Janet Yellen and viewed as a dove by many. He is, however, along with Yellen and one or two others the top dogs at this Fed and his barking gets attention accordingly.