Some will say risk back on as the weak yen has perhaps fueled investor risk appetite once again. A spike in crude oil prices also helped as production cuts were again in the discussion. The Shanghai Composite Index rallied 0.4% after a 1.5% upturn on Monday. The dollar was last up 0.3 percent against the yen at 103.90 yen, helping exporters.

One observer noted: "Crude prices in the U.S. jumped more than 3 percent after Russia said it was ready to join the Organization of the Petroleum Exporting Countries' (OPEC) output freeze deal, which was loosely agreed in September in a bid to cut the global supply overhang that has weighed on prices."

The Kospki was off -1.03%, the ASX 200 slightly up 0.08% and the Hang Send down -1.31%. Spot gold prices were trading lower by 0.16 percent at $1,257.40 an ounce, after two consecutive sessions of gains, as the dollar strengthened on increased expectations of the Federal Reserve raising rates in December.

----

Here's a report from Reuters:

One observer noted: "Crude prices in the U.S. jumped more than 3 percent after Russia said it was ready to join the Organization of the Petroleum Exporting Countries' (OPEC) output freeze deal, which was loosely agreed in September in a bid to cut the global supply overhang that has weighed on prices."

The Kospki was off -1.03%, the ASX 200 slightly up 0.08% and the Hang Send down -1.31%. Spot gold prices were trading lower by 0.16 percent at $1,257.40 an ounce, after two consecutive sessions of gains, as the dollar strengthened on increased expectations of the Federal Reserve raising rates in December.

----

Here's a report from Reuters:

TOKYO, Oct 11 Japan's Nikkei share average gained on Tuesday, led by mining stocks after oil prices jumped the previous day and a weak yen lifted risk appetite.

The Nikkei rose 1.0 percent to 17,020.62 in midmorning trade, while the broader Topix rose 0.9 percent to hit a four-month high of 1,362.33.

Investors returned from a long weekend to find overseas developments had benefited Japanese stocks while markets in Japan were closed on Monday for a national holiday.

Intensely scrutinised U.S. jobs data on Friday showed that U.S. employment growth eased for the third straight month in September and the jobless rate rose, but the slowdown was not expected to prevent the Federal Reserve from raising interest rates later this year.

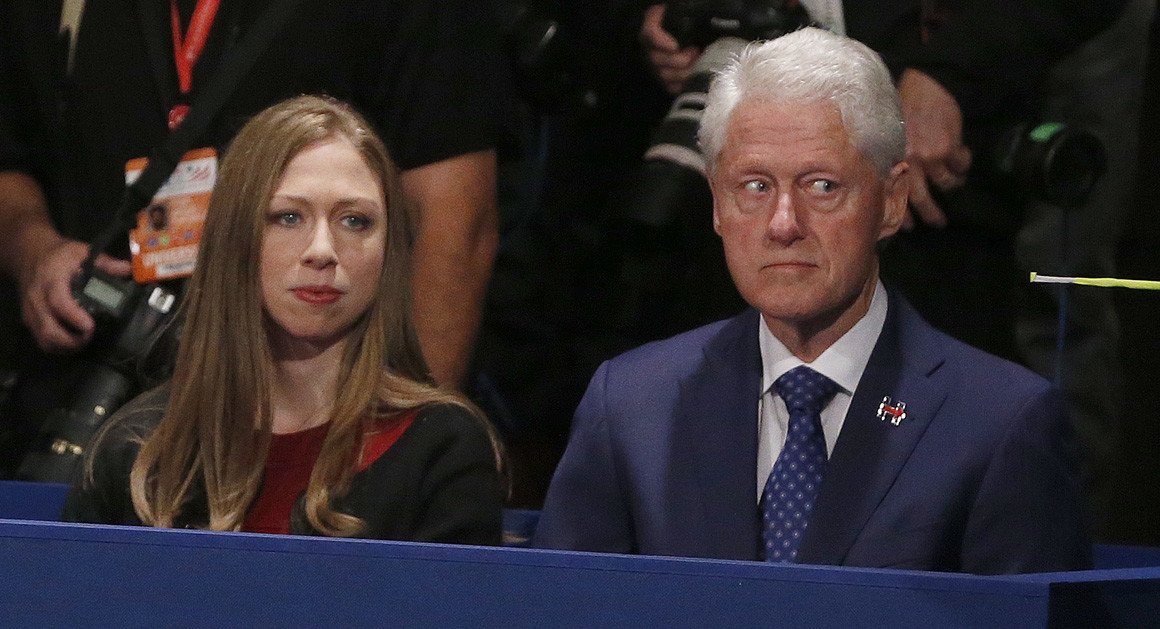

Meanwhile, after the second U.S. presidential debate on Monday, most investors saw Democrat Hillary Clinton holding a lead in the U.S. presidential election over Republican rival Donald Trump.

"Nothing has been decided yet... we are not 100 percent sure on a U.S. rate hike or a Clinton presidency. But the outcomes of the key events over the weekend were seen helping the Japanese market," said Takuya Takahashi, a strategist at Daiwa Securities.