The QEs have had it.

Trusting souls want to believe Bernanke stands at the ready, rescue button in hand. That's an old, old movie. The monetary wiggle string is mostly all out. Another round of QEs could further spike raw material prices, picking more money from consumer pockets, something rebounding energy costs is already doing.

Economic growth prospects in most developed areas are anemic; shortfalls in corporate earnings and declining retail sales are but a few of the current economic downers facing investors. A case in point, high-end retailer Coach shareholders witnessed a 17% decline in its stock price recently. Or Tiffany's shares, down nearly 5% since late last month.

On the other side of the retail trade is Walmart. Its shares are up dramatically in just the last two months, trading at 73 and change, just off its 52-week high. Some refer to this as slum retailing as folks pinched for capital downsize their spending seeking more bang for their buck.

And forget about jobs. Most folks have. The prospect of higher taxes beginning next year and fewer incentives to invest sound more and more like a super-sized horse-meat sandwich--unappealing, to put it kindly. Where is Mayor Bloomberg when you need him? Super-sized soft drinks maybe persona non in high places, but BS as always rides free.

That the trusty Fed stands ready is more whistling past the bone yard. Bond dealers and some big-time investors are suggesting the US Treasury float short-term paper with negatives yields. That should palliate the worries of fixed-income investors. QEs are DOA, just ask the smart money.

Markets may climb the proverbial worry-wall from time to time. But short of defaults and higher inflation, few have discovered the magic formula for cheating the piper.

Thursday, August 2, 2012

Thursday, May 31, 2012

Risk-free return versus free-return risk

Well now,Spainish 10-year government bonds are yielding around 6.7%, given a negative or positive news day or two, versus US 10-year government bonds coughing up the prodigious sum of 1.65%.

Confusion reigns top draw as to just how the Spainish government will rescue one of its largest banks,Bankia,that has been grabbing much of the negative headlines for a while now.

Over in the UK 10-year government bonds are yielding 1.64%,the lowest on record since records have been kept,dating back to 1703. The current yield on 10-year German government Bunds is a paltry 1.37%.

This so-called flight to safety,many believe, reflects investor worries about more deflation,but a surprise when all is said and done and government printing presses finally go tilt could be just the opposite of what the safe haven crowd expects.

Wednesday, May 30, 2012

The Unexpected

Just a short time ago the S&P 500 index closed above 1400, a move it's made several times over the last decade or so. The first time it closed above 1400 was July 9,1999. Looking at a chart, the S&P 500 formed a classic M-shaped top in late April-May before dropping down to its 200-day moving average support area of 1282.

Less than a year ago the S&P traded well below its 200-day moving average, making a classic W or inverted-M double bottom at the 1100 level. The end of May just might be signaling a big move below the 200-day moving average. It's for sure no one knows what the upcoming summer will bring investors. Pessimism is high,especially over Euroland. However well-deserved given Europe's ugliness, a rally could be in the offing even if the index breaks below the 1200 level.

Thursday, January 19, 2012

OVERDONE

The US Treasury recently unloaded a bunch of 10-year debt with a yield of 1.9%, selling into demand for these anemic 10-year puppies that was the third highest on record. The official inflation rate--assuming anyone out there still believes that--is now actually higher that the 1.9% yield investors are scrambling to get.

This is the old boiling-the-frog method of a slow capital death. It's the just-give-me-back-my-money-and-forget-about-any-returns mantra of the times. Maybe it's time to consider taking the other side of that trade and ramping up for unexpected higher interest rates down the road? Sooner or later overdone gets undone.

This is the old boiling-the-frog method of a slow capital death. It's the just-give-me-back-my-money-and-forget-about-any-returns mantra of the times. Maybe it's time to consider taking the other side of that trade and ramping up for unexpected higher interest rates down the road? Sooner or later overdone gets undone.

Sunday, January 1, 2012

What Do I Know?

What I do know is equity risk premiums are near 40 year highs, meaning the premium equity holders require to hold stocks over bonds; many of these stocks are paying decent dividends well above what so-called safer Treasury bonds pay; predictions, as they usually are, for 2012 run the gamut; developed markets including the US are supposed to underwhelm; last year the so-called no-brainer was shorting or avoiding US Treasury bonds. They were expected to go down not up in value, sending yields much higher. Gold enjoying a 10-year run had become every man’s safe haven of choice with a gaggle of radio talk show hosts hawking the yellow stuff.

Though we only have intuitive evidence, second term presidents are usually not as effective. An Obama re-election, if it occurs, will be a concession not a mandate. Plenty of people are fed up with the Obama administration and they are hardly religious, right wing or racist nuts despite what the media portrays. With that said we like big pharmaceuticals and healthcare; we like energy and defense given the turmoil worldwide

The famous, fictional Gordon Gecko pointed out that greed is good and it is. And so, too, is gridlock. The problem is always the same as in whose ox is getting gored. Oprah Winfrey at her height was earning 30 times the annual salary of the highest paid American corporate executive. The top 10 Hollywood celebrities earn a big multiple of what those corporate executives earn and we won’t even mention the highest paid sports figures. See anyone picketing them? Money can be made off of gridlock and it should be. It’s called a semi-free market. Bernanke with his QE babble has essentially tried to put a put option below the market.

Manufacturing is on a rebound in the US owing in part to China

A friend retired after being in medicine for 25 years. He decided he wanted to do something different, like selling since he viewed himself a people person. One day after numerous applications, a few interviews and much waiting he found himself sitting in a huge high riser across the desk from a corporate executive dressed in the obligatory blue suit, white shirt and red tie. Several plaques and an Ivy League MBA degree framed the wall behind the executive.

They sat in silence for a long time while the suit perused my friend’s resume.

“I don’t see anything here, “the suit said, finally breaking the silence, “that says you can sell. What makes you think you can sell our product?”

My friend said he paused for a long second because turnaround is fair play before he responded: “Because for the last 25 years I’ve been selling the hardest product on the planet.”

There was another longer, more awkward silence as the executive pondered my friend’s reply. It was almost as if, my friend recalled, you could see the wheels of his MBA grey matter spinning.

“And what might that be?”

“Trying to get people to change their behavior,” my friend shot back.

The safe bet here is, short of a real collapse; go against behavior changes of any serious magnitude. And that’s what I know.

Tuesday, December 27, 2011

Forecasting Has Its Pitfalls and 2012 Will Prove No Different

A bunch of hedge fund managers, most who probably don’t give a tinker’s damn for much beyond the bottom line anyway, has a lousy year, and the world is coming apart.

Politicians around the globe act like politicians, dawdling and fiddling in the face of stress, and the sky is descending post haste. Hedge fund managers and politicians share at least one commonality; they both love excuses.

Somebody once pointed out that 80 percent of the work that gets done in the world everyday gets done by people who don’t feel all that good. Maybe that number is a bit high, but it illustrates an important point. Things are not always what they look like.

The Euroland mess has dominated the news for weeks now and just about anyone who claims to have the cure has had his or her say. Some argue it’s the cluck-headed Germans and their insistence on fiscal responsibility. Others suggest the restraint on the European Central Bank should be eased so they can print money much like the US Federal Reserve. Problem is someone forgot to ask the Brits and the Fins.

One scribe, Henry Blodget, the discredited former Merrill Lynch sell-side analysts who was publicly hawking tech stocks during the tech mania he privately believed were POS, recently penned a rambling piece trying to prove that the wealthy don’t create jobs. Now the CEO of a financial news outlet, Blodget cited a wealthy dude to buttress his case. It’s a screed all about taxing those filthy wealthy folks who never pay their fair share of anything. Simple translation: we need higher taxes to offset higher spending Keynesians always love when the warm rubber begins to melt as it hits the freeway. When is the last time you were hired by someone or some company poorer than you?

The point here is there is no shortage of opinions and there never will be. Nor will there be a paucity of forecasting for 2012.

But there is certainly lots of uncertainty heading into 2012 and the European mess is only part of the story: A hard Chinese landing, gridlock in DC, sounds like a movie title if you close your eyes for a second and let your mind wonder; jobs, housing, consumer spending, corporate profits, to name a few of the more mundane. And of course there is usually a surprise or two waiting just around the corner of Wall and Broad Street. Don’t forget: 2012 is also an election year. The language debasers will be afoot in full force.

What about King Bernanke and his minions at the Fed ? What will they do? Will bond yields go up or down or just sort of lay there, lame and limp, like our elected officials? Is there anyone still left who hasn’t refinanced his or her digs? Will the dollar gain more testosterone or is it about to succumb to a bad case of ED? And what about gold, the yellow stuff some think will trade in 2012 between 1,300 and 2,000? And then there are all those emerging markets that for the most part suddenly stopped emerging in 2011. And who will be the 2012 Bill Gross poster child? And what sector will lead the parade?

The Omaha Hypocrite, Warren Buffett, rolled into Californian a few years back and suggested the state’s property owners needed to pay higher property taxes. Buffett at the time had a place in La Jolla, a wealthy seaside town just north of San Diego and he claimed the taxes on his Omaha residence were higher than those he was paying for his swanky California

Now Buffett is supposed to be a smart guy. Assuming Buffett and his secretary both live in Omaha, given their heavy tax burden, not to mention the lousy weather, perhaps both should consider moving; hopefully, however, not to California. We already have our fair share of kooks.

Still another point to Buffett’s hypocrisy, one recently noted by a fellow billionaire, Buffett’s whole strategy, buy and hold, is not only well known but calculated to avoid paying any taxes so that when he dies it all goes to a foundation and he won’t have paid taxes on any of it. Meanwhile, he certainly enjoyed the fruits of his labor, but like most people on the left apparently doesn’t want anyone else to enjoy theirs.

It’s still a few months before the ides of March, but that doesn’t mean investors shouldn’t be alert. Forecasting is a lot like a good saloon brawl. Anything can happen and it often does.

Saturday, December 24, 2011

Buffett-Obama Chart

RAIL DELIVERY OF CRUDE OIL AND PETROLEUM PRODUCTS RISING

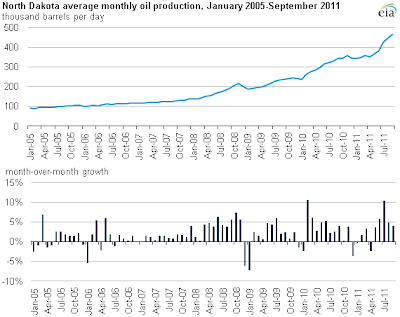

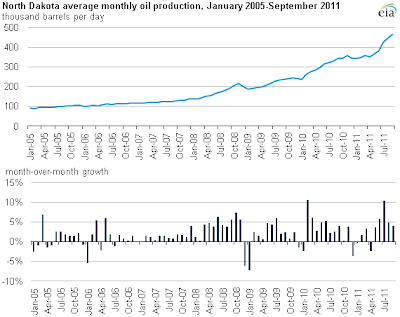

More U.S. crude oil is being shipped by rail, especially from North Dakota where a lack of pipelines has companies relying on tank cars to bring the state's soaring oil production to market. Pipelines remain the most popular transport option, carrying about two-thirds of U.S. oil and petroleum products, but rail is on the rise.

The Association of American Railroads (AAR) tracks combined rail movements of oil and refined petroleum products. In the first ten months of 2011, nearly 300,000 tank cars transported U.S. oil and petroleum products, up 9.1% from the same period in 2010, according to AAR. The growth in petroleum-by-rail shipments is much stronger than the 1.8% increase for all railroad cargo combined during the same period.

While AAR does not issue separate data on crude oil and product shipments via rail, it notes that anecdotal evidence indicates most of the growth in the crude oil and petroleum products category is likely due to crude shipments. Based on different sources of rail traffic data, the trade group said shipments of crude oil and liquefied natural gas accounted for about 2% of all carloads in 2008, 3% in 2009, 7% in 2010, and about 11% so far in 2011. One carload holds 30,000 gallons of oil.

BNR is the second largest railroad in the U.S. and as the chart illustrates with the darker lines BNR has a neavy presence in the North Dakota-Montana oil basin. Map of the Bakken Formation oil and gas play. The Bakken is below parts of northwestern North Dakota, northeastern Montana, southern Saskatchewan and southwestern Manitoba.

By Catherine Kim

and Jessica Hopper

Rock Center

Those hurt hard by the ailing economy are flocking to Williston, N.D., where an oil boom has turned a sleepy prairie town into a place producing thousands of jobs.

"There's opportunity here and that's what we all need is opportunity," said Williston Mayor Ward Koeser. "It's kind of been an oasis for the country. You know, there's a lot of jobs here, good paying jobs in the oil industry."

A job on an oil rig can pay as much as six figures. The starting salary for truck drivers is around $80,000. While the nation's unemployment rate is 9.1 percent, Williston's unemployment rate is less than 1 percent.

Locals say job seekers from all 50 states are heading to the North Dakota town, becoming modern-day pioneers. The town's population has nearly doubled from 12,600 people to 23,000 people. Patrick Parker hitchhiked from Yuba City, Calif., to Williston. When NBC News spoke to him, he had just $12 in his pocket. Parker, a paving stone layer by trade, has been out of work for two years.

"One of my goals is to make my daughters proud of me," said an emotional Parker. "I want to make them proud because I worked a good job for 10 years and then for it to go away it's just, it just gets to me a little bit." Parker is one of a dozen people NBC News saw setting up camp or living in their cars in the parking lot of the local Wal-Mart. Williston's housing construction hasn't caught up with its rapid growth.

Parker said the town feels "like the old gold rush town."Oil was discovered in the this part of North Dakota 60 years ago, but it was only recently that oil producers have found a way to get at it more effectively. After drilling about two miles down, they drill horizontally for another two miles through the bed of rock where the oil is trapped. Using a technique called fracking - water, sand and chemicals are shot into the rock formation from that horizontal pipe to create cracks and fractures. From those openings, comes the oil. Those in the oil industry say the tight rock that traps the oil, also prevents it from escaping into the water table during the fracking process.

North Dakota is currently the fourth largest producer of oil in the United States, but that is projected to change soon. A spokesperson for North Dakota’s Mineral Resources Department said that oil production in the state is expected to surpass Alaska and California by 2015 which means North Dakota will be the second largest oil producer in the country soon.Along with the bounty from the oil boom, come some stresses and strains. A sewage system that's running at full tilt, truck traffic congestion, an influx in 911 calls-those are just a few of the headaches that keep Mayor Koeser up at night.

There is such a large influx of people that thousands are staying in 'man camps'- shipping containers converted into housing units for the workers new to town. When more teachers were hired to deal with the rising number of students, an apartment building had to be built to house the new teachers, Koeser said.

"When we have as many people come here everyday looking for work, where are they going to live," Koeser asked. "How are we going to get water to them and sewer to them and a road to them and power to them and all those sorts of issues. Yeah, it's putting a tremendous amount of pressure on the infrastructure."

Of all the stresses, the biggest strain on the community is truck traffic, the mayor said.

"That's really stressing us, the traffic, a lot of accidents," said Koeser. "In a small community, you're used to getting from one side of town to the other in just a few minutes, that's no longer the case."

The number of accidents in September were double the amount the same time a year ago, the Williston Herald reported.

The surplus of people living in the town coupled with the traffic accidents has led to a drastic rise in calls to 911. Koeser said that the police receive at least 10,000 more calls a year than in pre oil boom times.

"Now keep in mind, you've got, you know, probably 9,000 men living in man camps around the city, not in the city limits, but living around the city and what do they do at night when they're done with work? They come to town and find a bar and want to have a good time, and sometimes get in trouble," Koeser said.

But that means more jobs: the town is adding six new policeman and three dispatchers this year, the mayor said.

Even with the headaches, Koeser said he and Williston's other residents are lucky that the town has become an oasis for job seekers.

What Does Buffett’s Purchase of Burlington Northern Say About Commodities and the Dollar?

Posted By admin On November 5, 2009 @ 11:00 am In Commentators,Commodities,Logistics |

Every story I have seen on Warren Buffet’s purchase of Burlington Northern for $26.3b earlier this week contains a different take on “why” Berkshire Hathaway did the deal. Of course we at MetalMiner have our own $.02 (which we have included), but thought you may appreciate glancing through all the possible reasons for “why this deal.”

Top 6 Reasons Warren Buffett (Berkshire Hathaway) Bought Burlington Northern:

1. Perhaps Mr. Buffett has forgotten his own rules of investing? This article discusses how he violates his own rules [1] for “buying cigar butts” and not splitting his own stock

2. A very popular argument [2] put forth as to the rationale behind the purchase goes like this: Buffett believes the US economy is poised to come roaring back fueling the need for the movement of goods across our vast country

3. Some believe he had too much cash on hand, $37b to be exact, something Buffett himself says limits his ability to make money [3]

4. Buffett believes that crumbling roads and failing infrastructure along with increased environmental pressures around carbon emissions represent a boon to rail [4]

5. Buffett is signaling where he thinks dollars [5] will get spent (e.g. on commodities), “Instead of turning to gold, Buffett sees Burlington Northern as a growth vehicle to earn more on the billions in cash Berkshire has on its books carrying coal, wheat and other resources across the nation.”

6. Or, my personal favorite, is Buffett buying the railroad because, “This is all happening because my father didn’t buy me a train set as a kid,” Mr. Buffett joked in an interview [6].

The Times article suggested that the deal made sense, even using Buffett’s own investing maxims: only buy what you understand, buy at bargain prices and move quickly. Unlike the Times article, though, we would argue the deal was not “a bargain” and subscribe to the Wall Street Journal point of view. Burlington Northern was no “cigar butt.”

What’s our take? The purchase likely involves several of these rationales. But when Warren Buffett does the biggest deal of his career and it happens to involve trains to carry commodities, do we have any doubt as to where the Sage from Omaha thinks metal markets will move?

Cornelius Vanderbilt must be chuckling in his grave.

Buffett for years has been known as the Omaha Scold, but given what we now know about the facts and his support of Obama, the Omaha Hypocrite might be more appropriate.

This is what we call our Warren Buffett-President Obama chart. You’ll recall Buffett gave Obama a boost in ratings early in 2011 when he made his statement, bogus though it was, about his secretary paying more taxes than he did. Most of Buffet’s income came via capital gains, taxed at the capital gains rate of 15%, not the earned income rate. That’s the only way his secretary paid more income tax and even then it’s a bogus claim.

Obama later repaid the favor this fall when he canceled the Canadian pipeline project until after the election in 2012. Recall, too, that Buffett owns Burlington Northern Railroad. Buffett had a 22 percent stake in BNR unitl Novemeber, 2009 when he bought out the rest for around $34 billlion.

The pipeline, Keystone XL from Canada, was going to create thousands of jobs in the lower 48. The Obama administration has pretty much been a jobless one including all those now defunct jobs in the solar industry that somehow went bankrupt after wasting tons of OPM. So Mr. Obama must have owed Mr. Buffett big time.

The pipeline, Keystone XL from Canada, was going to create thousands of jobs in the lower 48. The Obama administration has pretty much been a jobless one including all those now defunct jobs in the solar industry that somehow went bankrupt after wasting tons of OPM. So Mr. Obama must have owed Mr. Buffett big time.

Note: Data are weekly average originations for each month, are not seasonally adjusted, and exclude U.S. operations of Canadian National Railways and Canadian Pacific Railway; one carload holds 30,000 gallons.

More U.S. crude oil is being shipped by rail, especially from North Dakota where a lack of pipelines has companies relying on tank cars to bring the state's soaring oil production to market. Pipelines remain the most popular transport option, carrying about two-thirds of U.S. oil and petroleum products, but rail is on the rise.

The Association of American Railroads (AAR) tracks combined rail movements of oil and refined petroleum products. In the first ten months of 2011, nearly 300,000 tank cars transported U.S. oil and petroleum products, up 9.1% from the same period in 2010, according to AAR. The growth in petroleum-by-rail shipments is much stronger than the 1.8% increase for all railroad cargo combined during the same period.

While AAR does not issue separate data on crude oil and product shipments via rail, it notes that anecdotal evidence indicates most of the growth in the crude oil and petroleum products category is likely due to crude shipments. Based on different sources of rail traffic data, the trade group said shipments of crude oil and liquefied natural gas accounted for about 2% of all carloads in 2008, 3% in 2009, 7% in 2010, and about 11% so far in 2011. One carload holds 30,000 gallons of oil.

BNR is the second largest railroad in the U.S. and as the chart illustrates with the darker lines BNR has a neavy presence in the North Dakota-Montana oil basin. Map of the Bakken Formation oil and gas play. The Bakken is below parts of northwestern North Dakota, northeastern Montana, southern Saskatchewan and southwestern Manitoba.

Now hiring: North Dakota oil boom creates thousands of jobs

Thu Oct 27, 2011 1:43 AM EDTBy Catherine Kim

and Jessica Hopper

Rock Center

Those hurt hard by the ailing economy are flocking to Williston, N.D., where an oil boom has turned a sleepy prairie town into a place producing thousands of jobs.

"There's opportunity here and that's what we all need is opportunity," said Williston Mayor Ward Koeser. "It's kind of been an oasis for the country. You know, there's a lot of jobs here, good paying jobs in the oil industry."

"A lot of jobs get filled every day, but it's like for every job you fill, another job and a half opens up," Koeser said.

A job on an oil rig can pay as much as six figures. The starting salary for truck drivers is around $80,000. While the nation's unemployment rate is 9.1 percent, Williston's unemployment rate is less than 1 percent.

Locals say job seekers from all 50 states are heading to the North Dakota town, becoming modern-day pioneers. The town's population has nearly doubled from 12,600 people to 23,000 people. Patrick Parker hitchhiked from Yuba City, Calif., to Williston. When NBC News spoke to him, he had just $12 in his pocket. Parker, a paving stone layer by trade, has been out of work for two years.

"One of my goals is to make my daughters proud of me," said an emotional Parker. "I want to make them proud because I worked a good job for 10 years and then for it to go away it's just, it just gets to me a little bit." Parker is one of a dozen people NBC News saw setting up camp or living in their cars in the parking lot of the local Wal-Mart. Williston's housing construction hasn't caught up with its rapid growth.

Parker said the town feels "like the old gold rush town."Oil was discovered in the this part of North Dakota 60 years ago, but it was only recently that oil producers have found a way to get at it more effectively. After drilling about two miles down, they drill horizontally for another two miles through the bed of rock where the oil is trapped. Using a technique called fracking - water, sand and chemicals are shot into the rock formation from that horizontal pipe to create cracks and fractures. From those openings, comes the oil. Those in the oil industry say the tight rock that traps the oil, also prevents it from escaping into the water table during the fracking process.

North Dakota is currently the fourth largest producer of oil in the United States, but that is projected to change soon. A spokesperson for North Dakota’s Mineral Resources Department said that oil production in the state is expected to surpass Alaska and California by 2015 which means North Dakota will be the second largest oil producer in the country soon.Along with the bounty from the oil boom, come some stresses and strains. A sewage system that's running at full tilt, truck traffic congestion, an influx in 911 calls-those are just a few of the headaches that keep Mayor Koeser up at night.

There is such a large influx of people that thousands are staying in 'man camps'- shipping containers converted into housing units for the workers new to town. When more teachers were hired to deal with the rising number of students, an apartment building had to be built to house the new teachers, Koeser said.

"When we have as many people come here everyday looking for work, where are they going to live," Koeser asked. "How are we going to get water to them and sewer to them and a road to them and power to them and all those sorts of issues. Yeah, it's putting a tremendous amount of pressure on the infrastructure."

Of all the stresses, the biggest strain on the community is truck traffic, the mayor said.

"That's really stressing us, the traffic, a lot of accidents," said Koeser. "In a small community, you're used to getting from one side of town to the other in just a few minutes, that's no longer the case."

The number of accidents in September were double the amount the same time a year ago, the Williston Herald reported.

The surplus of people living in the town coupled with the traffic accidents has led to a drastic rise in calls to 911. Koeser said that the police receive at least 10,000 more calls a year than in pre oil boom times.

"Now keep in mind, you've got, you know, probably 9,000 men living in man camps around the city, not in the city limits, but living around the city and what do they do at night when they're done with work? They come to town and find a bar and want to have a good time, and sometimes get in trouble," Koeser said.

But that means more jobs: the town is adding six new policeman and three dispatchers this year, the mayor said.

Even with the headaches, Koeser said he and Williston's other residents are lucky that the town has become an oasis for job seekers.

What Does Buffett’s Purchase of Burlington Northern Say About Commodities and the Dollar?

Posted By admin On November 5, 2009 @ 11:00 am In Commentators,Commodities,Logistics |

Every story I have seen on Warren Buffet’s purchase of Burlington Northern for $26.3b earlier this week contains a different take on “why” Berkshire Hathaway did the deal. Of course we at MetalMiner have our own $.02 (which we have included), but thought you may appreciate glancing through all the possible reasons for “why this deal.”

Top 6 Reasons Warren Buffett (Berkshire Hathaway) Bought Burlington Northern:

1. Perhaps Mr. Buffett has forgotten his own rules of investing? This article discusses how he violates his own rules [1] for “buying cigar butts” and not splitting his own stock

2. A very popular argument [2] put forth as to the rationale behind the purchase goes like this: Buffett believes the US economy is poised to come roaring back fueling the need for the movement of goods across our vast country

3. Some believe he had too much cash on hand, $37b to be exact, something Buffett himself says limits his ability to make money [3]

4. Buffett believes that crumbling roads and failing infrastructure along with increased environmental pressures around carbon emissions represent a boon to rail [4]

5. Buffett is signaling where he thinks dollars [5] will get spent (e.g. on commodities), “Instead of turning to gold, Buffett sees Burlington Northern as a growth vehicle to earn more on the billions in cash Berkshire has on its books carrying coal, wheat and other resources across the nation.”

6. Or, my personal favorite, is Buffett buying the railroad because, “This is all happening because my father didn’t buy me a train set as a kid,” Mr. Buffett joked in an interview [6].

The Times article suggested that the deal made sense, even using Buffett’s own investing maxims: only buy what you understand, buy at bargain prices and move quickly. Unlike the Times article, though, we would argue the deal was not “a bargain” and subscribe to the Wall Street Journal point of view. Burlington Northern was no “cigar butt.”

What’s our take? The purchase likely involves several of these rationales. But when Warren Buffett does the biggest deal of his career and it happens to involve trains to carry commodities, do we have any doubt as to where the Sage from Omaha thinks metal markets will move?

Cornelius Vanderbilt must be chuckling in his grave.

Buffett for years has been known as the Omaha Scold, but given what we now know about the facts and his support of Obama, the Omaha Hypocrite might be more appropriate.

Wednesday, December 21, 2011

Holiday Greeting

Monday, December 19, 2011

US Retail Space and the European Mess

Thought about an old acquaintance today, we’ll call him Harry.

Harry unfortunately is no longer with us. I first met Harry years ago when he was an in-patient on a medical ward in a large, cold, indifferent hospital in an even larger, colder, more indifferent big city. Already in his 80s, his body was frail, but his mind laser-beam sharp.

One of Harry’s most prized possessions was a faded birthday card from his only surviving relative, a niece living in a distant city, whom he hadn’t seen in years. He kept the card sitting on the nightstand next to his bed like a trophy on display so he could show it to anyone and everyone who ventured into his room.

For most that passed in and out Harry was, understandably, just an old guy really late on the back nine of his life. To me he was a treasure trove of information, in some ways worthy of the status of a national monument.

Harry spent his professional life trading commodities. He jokingly told me once that over his career he traded everything from cotton to soybeans to wives. Listening to him as the days passed pull streams of commodity prices out of his head, each with its fascinating own story, told me everything I wanted to hear, someone who had been there, seen it and survived.

Back then I was early on the front nine of my life, trying to learn how to effectively practice some serious internal medicine. So time was a critical commodity for both of us. Whenever I could I dropped by his room, pulled up a chair and started firing questions. He never seemed to mind. If anything it seemed to take 10 or 15 years off his face. I found out Harry several times in his life had been up and he had been down. Up is always better he told me.

One day we were discussing high lumber prices when he suddenly stopped, paused for several seconds and said: “Listen, son, this is a point the politicians, the bureaucrats and all those regulators never seem to get; and probably never will. The cure for high prices is high prices.” It was a simple, declarative statement, probably too simple to be appreciated by many.

What brought Harry to mind after all these years is an article about US

The article, “Too many shops, too few shoppers,” quoting from a book by Robin Lewis and Michael Dart, The New Rules of Retail, about the economic downturn’s effect on store traffic and excessive retail space, points out: “To put the excess in a wider context, Mr Lewis and Mr Dart say the US has 22 sq .ft of retail space for every person in the country. The second highest figure is Sweden

No doubt some will point out there is a big difference in population between Sweden and the US

“The process of shedding space began this year at Gap…whose prolonged slump came because it opened too many stores….” Gap isn’t, unlike some others, Borders and Circuit City

There are two ways to reduce excess; the harsher of the two is called bankruptcy.

The difference between Circuit City

Think about it. Isn’t this what the bond investors are really saying to all those European bureaucrats and politicians? And that's why it's just as importnat to let the market process work.

Sunday, December 18, 2011

Mood Pie Anyone?

There are many mood indicators and we'll only touch on a few here and in no particular order of importance. That's up to you to decide, how many and which.

Auctions as in bonds: The US just sold $13 billion 30-year Treasuries at the lowest yield ever, 2.925 percent. The sale reflects several things about investors' mood: fear or flight to safety; concern about further global economic slowdown and less inflation worries because of it. Auctions also tell you about how well an offering is received or how much of a market there is for it.

Not all auctions are received the same and that brings us to another mood indicator: comparative yields or spreads between offerings by different countries. Take a benchmark for each country, like the recent 10-year government notes yielding 6.5 percent of Italy versus similar notes sold by France yielding 3.04 percent and 10-year US Treasuries offering only 1.85 percent. The German 10-year bund also yields 1.85 percent, giving you a pretty good snapshot of how the market (investors) see risk, in this case default risk. Risk has many faces, interest rates, inflation, political, liquidity, correlation, to name a few. Correlation stated simply is the company you choose to hang out with, the old room full of measles.

Another mood indicator that's been on public display more lately than usual is rating agencies like Fitch, Moody's and Standard & Poor. All have either issued downgrades or imposed warnings about certain sovereign debt and the financial state of those issuing countries' ability to service that debt. Sometimes these rating agencies are late to the chaos as was the case with the Asian tigers in the late 1990s, but their rating changes or warnings bear noting if for no other reason than getting a fix on general mood.

Gold prices, though not always direct, are another mood indicator. Because of its "safe haven" reputation gold prices often reflect fears or the lack thereof about inflation or loss of purchasing power. Gold can also be a proxy on the fate of the US dollar, though again not always linear, and even to a degree interest rates and bonds.

Copper prices are worth noting because of the metal's use in the housing and industrial markets, i.e., growth or economic pick-up versus pending slowdowns. Since gold and copper are commodities and commodities can be broken down into two groups, soft and hard, you probably want to look at currencies as yet another mood indicator.

Currencies can be roughly divided into two groups, commodity-based, like the the Aussie and Canadian dollars and the South African rand, and non-commodity based. In general, commodity-based currencies give some protection against inflation when prices are rising. Rising prices can be reflected in the CPI numbers, but they are not hard and fast because central bank bureaucrats don't like to use indicators in their indexes that are going to too broadly deviate from their agendas. Yes, central bankers world-wide have agendas; that should be one of your first mood indicators: What do central bankers want as opposed to want you want? Often they are not the same. Kick the can is a popular central bank game world-wide.

Energy prices matter. Recent headlines about solar panel prices falling and China glutting US markets with solar panels should indirectly tell you something about energy prices. Couple that with what's going on in the natural gas markets versus coal-powered electric utilities and you get a further snapshot, not to leave out what's rattling around with OPEC, Iranian and Syrian oil; and Libyan oil coming back on the market.

So energy prices can be a mood indicator for various reasons, but again just one of the many ingredients that go into to baking any good mood pie. Given the current holiday season, we wish you and all our readers happy, healthy, properous baking in 2012.

Bond auctions

Spreads

Currencies

CPI numbers

Gold and Copper

Rating Agencies

Energy

Auctions as in bonds: The US just sold $13 billion 30-year Treasuries at the lowest yield ever, 2.925 percent. The sale reflects several things about investors' mood: fear or flight to safety; concern about further global economic slowdown and less inflation worries because of it. Auctions also tell you about how well an offering is received or how much of a market there is for it.

Not all auctions are received the same and that brings us to another mood indicator: comparative yields or spreads between offerings by different countries. Take a benchmark for each country, like the recent 10-year government notes yielding 6.5 percent of Italy versus similar notes sold by France yielding 3.04 percent and 10-year US Treasuries offering only 1.85 percent. The German 10-year bund also yields 1.85 percent, giving you a pretty good snapshot of how the market (investors) see risk, in this case default risk. Risk has many faces, interest rates, inflation, political, liquidity, correlation, to name a few. Correlation stated simply is the company you choose to hang out with, the old room full of measles.

Another mood indicator that's been on public display more lately than usual is rating agencies like Fitch, Moody's and Standard & Poor. All have either issued downgrades or imposed warnings about certain sovereign debt and the financial state of those issuing countries' ability to service that debt. Sometimes these rating agencies are late to the chaos as was the case with the Asian tigers in the late 1990s, but their rating changes or warnings bear noting if for no other reason than getting a fix on general mood.

Gold prices, though not always direct, are another mood indicator. Because of its "safe haven" reputation gold prices often reflect fears or the lack thereof about inflation or loss of purchasing power. Gold can also be a proxy on the fate of the US dollar, though again not always linear, and even to a degree interest rates and bonds.

Copper prices are worth noting because of the metal's use in the housing and industrial markets, i.e., growth or economic pick-up versus pending slowdowns. Since gold and copper are commodities and commodities can be broken down into two groups, soft and hard, you probably want to look at currencies as yet another mood indicator.

Currencies can be roughly divided into two groups, commodity-based, like the the Aussie and Canadian dollars and the South African rand, and non-commodity based. In general, commodity-based currencies give some protection against inflation when prices are rising. Rising prices can be reflected in the CPI numbers, but they are not hard and fast because central bank bureaucrats don't like to use indicators in their indexes that are going to too broadly deviate from their agendas. Yes, central bankers world-wide have agendas; that should be one of your first mood indicators: What do central bankers want as opposed to want you want? Often they are not the same. Kick the can is a popular central bank game world-wide.

Energy prices matter. Recent headlines about solar panel prices falling and China glutting US markets with solar panels should indirectly tell you something about energy prices. Couple that with what's going on in the natural gas markets versus coal-powered electric utilities and you get a further snapshot, not to leave out what's rattling around with OPEC, Iranian and Syrian oil; and Libyan oil coming back on the market.

So energy prices can be a mood indicator for various reasons, but again just one of the many ingredients that go into to baking any good mood pie. Given the current holiday season, we wish you and all our readers happy, healthy, properous baking in 2012.

Bond auctions

Spreads

Currencies

CPI numbers

Gold and Copper

Rating Agencies

Energy

Subscribe to:

Posts (Atom)