Monday, May 5, 2014

NOT EVERYONE IS BUYING

Market guru says home builders over cooked, young people aren't buying and shares set for pullback in prices.

http/://blogs.marketwatch.com/thetell/2014/05/05/jeffrey-gundlach-shorts-home-builders-as-young-buyers-shun-mortgages/

Meanwhile, mortgage origination applications took big hit in 1Q from one year ago for same period at 10 largest banks. Can't blame it all on frigid winter.

http://m.thefiscaltimes.com/fiscaltimes/#!/entry/housing-slowdown-hits-large-banks,5367eed5025312186c02072f

HOT MONEY

http://en.wikipedia.org/wiki/1997_Asian_financial_crisis

To many it was a long time ago, 1997 in fact, when the Asian Tigers, as they were known, took the count. Though the reasons were legion, one of them was so-called hot money.

We're not suggesting there is any sort of parallelism here. What we are saying is hot money can be defined in many ways and it can show up in some of the strangest places, like your friendly regional or neighborhood bank.

Have stranger things happened, you bet. Being long on greed and short on history is usually not a good idea. But as they say: Time will tell.

http://www.minyanville.com/business-news/the-economy/articles/Peter-Atwater253A-The-Next-Banking-Crisis/5/5/2014/id/54848

THE YIELD CHASE

The chase for yield continues.

It's hard to see how this will not somehow end badly. Central bankers have created another kind of bubble, what we call in this instance a reverse bubble that bursts when rates go up more rapidly than investors expect.

Too many of these yield chasers will be left holding the bag, burned again in part by their own greed and by putting any trust in these clueless bureaucrats.

It might sound harsh but that's often the nature of reality.

http://soberlook.com

Sunday, May 4, 2014

AROUND THE WEB

1. SWISS FREEZE.

http://www.reuters.com/article/2014/05/04/us-ukraine-crisis-switzerland-idUSBREA4307N20140504

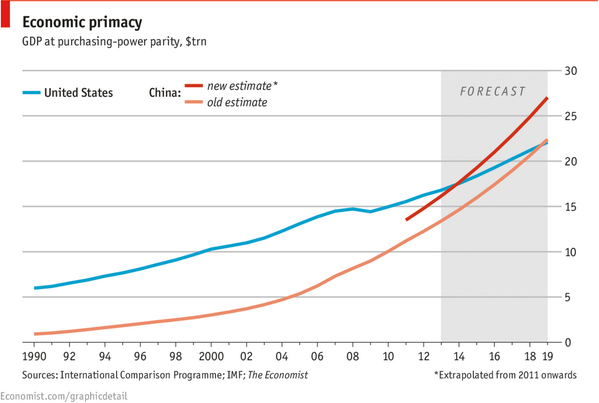

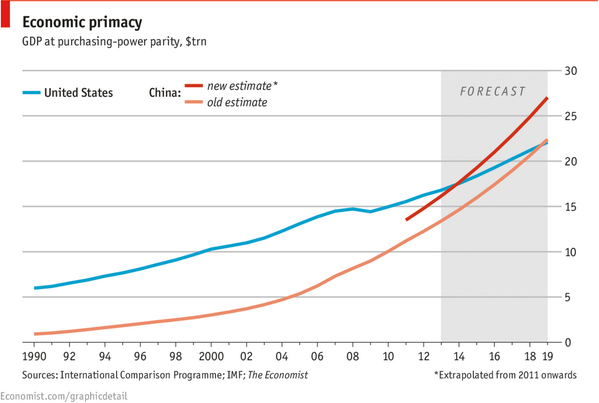

2. GDP GROWTH CHART

3. IT"S ABOUT READING

Trinity College Library Dublin

4.The S&P 500 gained 1.9% in the first four months, the smallest move in either direction since 1994.

Ben Levisohn, Barron's

5.Too Soon For Rate Hike

http://www.marketwatch.com/story/feds-fisher-too-soon-for-talk-of-rate-hikes-2014-05-04-131032417

6. Deflation Versus Inflation

http://online.wsj.com/news/articles/SB10001424052702304831304579541592785029998?KEYWORDS=simon+nixon&mg=reno64-wsj

7. April ended on a fairly positive note with all of the major US average up about 1% for the week. That comes as we head into what has been - at least over the last 5 years - the worst month of the year for the S&P 500. Courtesy of our Seasonality charting tool, here is the phrase "Sell in May and go away" pictured in one chart:

ChartWatchers, the StockCharts.com Newsletter

http://www.reuters.com/article/2014/05/04/us-ukraine-crisis-switzerland-idUSBREA4307N20140504

2. GDP GROWTH CHART

3. IT"S ABOUT READING

Trinity College Library Dublin

4.The S&P 500 gained 1.9% in the first four months, the smallest move in either direction since 1994.

Ben Levisohn, Barron's

5.Too Soon For Rate Hike

http://www.marketwatch.com/story/feds-fisher-too-soon-for-talk-of-rate-hikes-2014-05-04-131032417

6. Deflation Versus Inflation

http://online.wsj.com/news/articles/SB10001424052702304831304579541592785029998?KEYWORDS=simon+nixon&mg=reno64-wsj

7. April ended on a fairly positive note with all of the major US average up about 1% for the week. That comes as we head into what has been - at least over the last 5 years - the worst month of the year for the S&P 500. Courtesy of our Seasonality charting tool, here is the phrase "Sell in May and go away" pictured in one chart:

ChartWatchers, the StockCharts.com Newsletter

CONFIDENCE BUILDERS

Try these three reports on for confidence, one from the US, one from the EU and, just for good measure, one from the government.

Some might suggest these are positive signs. Maybe? We share a different take. Chaos reigns in the financial world. If you think not then you're not familiar with the fox and the hen house story.

http://www.theguardian.com/world/2014/may/04/greece-debt-relief-creditors-eurozone-crisis

http://soberlook.com/2014/05/kicking-pension-can-down-road.html

http://www.theguardian.com/money/us-money-blog/2014/may/04/bank-big-fail-stress-fed-america-economy

GREASY PALMS

Palm oil and the old saying about grease my palm may share more than you imagine.

If you're a reader of labels like we are then you know about palm oil, also known as vegetable oil. It's been around for years. And if it were any more wide spread it'd be one of my old girl friend's waistline. Note here the emphasis on old.

Trails usually start out wide and get narrower as you go along. Like a lot of things in big finance, however, this one is just the reverse. But keep going you just might discover some big names.

Hello, The World Bank and Deutsche Bank and Allianz, the owner of Pimco, the huge bond mutual fund run by Bill Gross, to name a few. Recall along the way Voltaire's comment about following a banker if he jumps out of a window 'cause there's mostly likely a profit in it.

Back to palm oil. Nearly one of every two products on your grocer's shelf contains palm oil. From cosmetics to food to household products, look carefully and you'll likely find some palm oil. It's even been mentioned as a possible bio-fuel to replace the fossil burning stuff. Much of it comes from Indonesia.

So that should tell you something about greasy palms.

http://www.spiegel.de/international/world/indonesian-villagers-driven-from-villages-in-palm-oil-land-theft-a-967198.html

THE BIG SQUEEZE

Could this be a warning sign? You'll have to decide for yourself. Sooner or later the punch bowl gets removed.

These things have a way of going on longer than many think. That's what makes timing so difficult. Few want to get out too late, but even fewer want to get out too soon. It's called seller's remorse. And the herd-driven MSM is one of the main accomplices. After all Joe Q. Public, via his and her retirement accounts, are just now transitioning to the equity party. And it's been a huge one.

The big squeeze is on. And the one thing the big squeezers have is patience. Got to give the tame rabbits time to get more than just their feet in the door. In the Elizabethan Era it was known as the art of coney catching.

Today: Same squeeze, different name.

Margin rates are to low interest rates as subprime is to defaults. There's more than enough burn room here to go around. So like the guy in the Dos Equis commercial always says: "Stay thirsty, my friends."

http://davidstockmanscontracorner.com/the-high-fliers-have-cratered-now-margin-debt-is-at-all-time-peakgdp-ratio-but-rolling-over/

Saturday, May 3, 2014

EVERY WAY BUT LOOSE

Some might not see this post as having much to do about the market and that's fine.

But there's been a sea change in Japan and we've written about it before, a mood change in the tiny once pacifist island country that held sway from 1945 until just recently.

It's like there's a new sheriff in town. With China and Russia sharing recent military operations and both countries' ties to Iran, the winds of change are in the air.

Toss in Japan's historical relations with China, a bureaucratic emasculated EU, the current quagmire in the Ukraine, clueless US foreign policy and it's beginning to look a lot less like a kinder, gentler world.

And by the way, did we mention North Korea?

Like it or not that's a world that can turn your investments every way but loose.

http://www.businessweek.com/articles/2014-05-01/japan-prepares-to-enter-the-arms-market#r=rss

http://www.reuters.com/article/2014/04/29/us-ukraine-crisis-russia-japan-idUSBREA3S0E420140429

GREAT GRAPHIC

More on the Ukraine. One should not forget there's an economic cost for Russia deploying all these resources that can't be helping their economy.

http://econbrowser.com/archives/2014/05/deployment-of-forces-ukraine

http://econbrowser.com/archives/2014/05/deployment-of-forces-ukraine

NO LIVE AND LET LIVE HERE

As the Ukraine situation seems to take daily turns for the worst, the man at the center remains Vladimir Putin.

Some say he's enigmatic. We say he's pretty easy to read if you care to read enough.

And here's another view. Though there's much here we would differ with--e.g., Putin's alleged war against material superficiality--according to what we've read he has billions of material superficialities floating around his various financial accounts.

And there's that "fight against the feminization and effeminacy of society." We all know what that means. We're sure most woman will laud that one, especially those who protest that their femininity is being jeopardized just for being feminine.

Fascism isn't, as many misperceive, about equal opportunities. It's about equal outcomes.

http://www.spiegel.de/international/world/speeches-by-russian-president-putin-betray-fascist-inspiration-a-967283.html

Subscribe to:

Comments (Atom)