1. SWISS FREEZE.

http://www.reuters.com/article/2014/05/04/us-ukraine-crisis-switzerland-idUSBREA4307N20140504

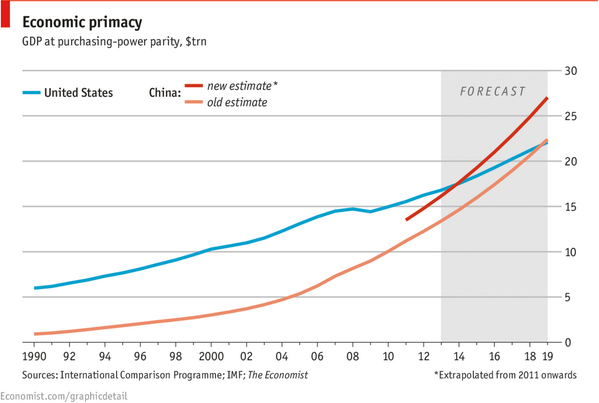

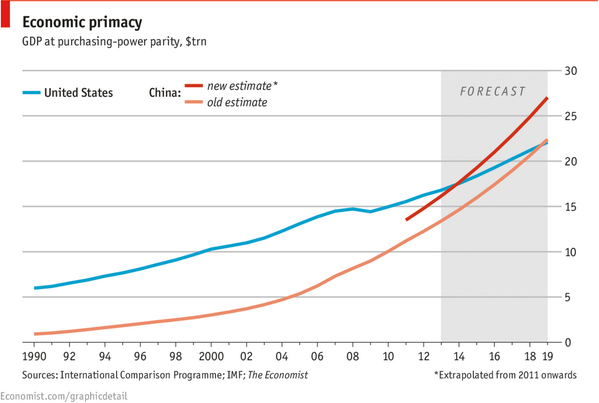

2. GDP GROWTH CHART

3. IT"S ABOUT READING

3. IT"S ABOUT READING

Trinity College Library Dublin

4.The S&P 500 gained 1.9% in the first four months, the smallest move in either direction since 1994.

Ben Levisohn, Barron's

5.Too Soon For Rate Hike

http://www.marketwatch.com/story/feds-fisher-too-soon-for-talk-of-rate-hikes-2014-05-04-131032417

6. Deflation Versus Inflation

http://online.wsj.com/news/articles/SB10001424052702304831304579541592785029998?KEYWORDS=simon+nixon&mg=reno64-wsj

7. April ended on a fairly positive note with all of the major US average up about 1% for the week. That comes as we head into what has been - at least over the last 5 years - the worst month of the year for the S&P 500. Courtesy of our Seasonality charting tool, here is the phrase "Sell in May and go away" pictured in one chart:

http://online.wsj.com/news/articles/SB10001424052702304831304579541592785029998?KEYWORDS=simon+nixon&mg=reno64-wsj

7. April ended on a fairly positive note with all of the major US average up about 1% for the week. That comes as we head into what has been - at least over the last 5 years - the worst month of the year for the S&P 500. Courtesy of our Seasonality charting tool, here is the phrase "Sell in May and go away" pictured in one chart:

ChartWatchers, the StockCharts.com Newsletter