It's pretty simple. A certain number of chairs are placed in a circle minus one versus the number of players. In short, 11 players but only 10 chairs. Then the music starts, the children move in circles until the music suddenly stops and all the kids scramble to find a seat. The one who doesn't find a seat is out of the game.

As we said, it's simple game, but one fraught with life lessons. Here's one of them: Something dramatic happens when the music stops. One might suggest the Federal Reserve has a clear understanding of this game. One might even go so far as to suggest at the risk of being labeled a cynic it's the only thing they have a clear understanding of.

Here's article from Zerohedge on the subject.zerohedge.com/news/2016-06-29/fed-finds-good-excuse-extend-and-pretend-through-brexit.

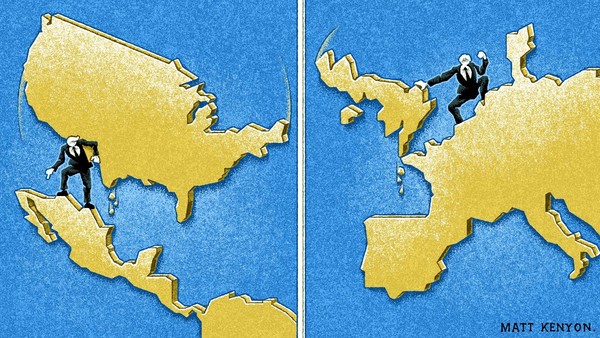

Brexit has happened. Those who are not happy with this reality are making their voices heard; yet, so too are those who are overjoyed to have their liberty and freedom back in their own hands.

This divide is glaringly obvious and has been the highlight of the news reel since last week's vote. There has been a flood of articles relating to the matter, and for good reason. This is a historic event and a move that slaps the global elites squarely in the face, something that rarely happens throughout our history.

Regardless, turbulent times are ahead for the global markets, as this move was considered a "black swan" event, one that was not expected by many, even by those who hoped it would happen. Even Nigel Farage, one of the leaders of the "Leave" campaign, suspected that the vote would be close, but didn't hold out hope that they would win.

Therefore, it is no surprise to find that the FED is also shocked by this turn of events. They, along with many others, did not expect this to happen - but never fear! They will take advantage of the situation and use it as a full-blown excuse as to why they once again cannot act and raise interest rates.

Brexit has essentially given Janet Yellen a perfect excuse as to why she cannot raise rates. The FED has been jawboning about a raise in rates once again over the past few months, something that I have highlighted time and time again.

This MOPE is a constant theme at just about any press conference the FED attends. They must keep people thinking that they have some sort of power, that they can unravel this mess they have created in the fiat markets. The fact is they cannot, and they know this.

If Brexit didn't occur, then the FED would have simply found another excuse to not raise rates. That, or they would have just engaged in more extend and pretend, pushing the idea down the road just a little further as they so often do.

Either way, near-rock bottom interest rates are here to stay as the U.S. dollar strengthens vs the pound and the Euro. As the elites say, never let a good crisis go to waste. Don't worry - the FED isn't.

What's important here is not so much the Fed's inactivity. It's the only refuge to maintain any semblance of credibility they have left. Once that's gone it's like that simple game of musical chairs--something dramatic happens. To put is another way: Someone once said that it is better to be thought of as a fool than to open your mouth and remove all doubt.

It doesn't matter what the Fed does next. Whatever it is it will remove all doubt.