Most people are familiar with the what goes around comes around theme.

What

they might not realize it holds true in places like Wall Street. A

story headline, "A Very Bad Year for Sot k Pickers," in the weekend

edition of the Wall Street Journal proves the case. It's no secret now

investors have been pulling big chunks of money out of managed mutual

funds, much of it headed to ETF's that try to take the personal, human

element out of the investing equation.

The legendary

Bill Miller of Legg Mason fame who picked his way to a phenomenal record

for years by picking stocks is leaving the firm he helped make famous

after 30 years. Miller is a name that rivals other stock picking

legends of the past like John Neff and Peter Lynch. And there have been

many others.

Index funds have come to the fore, pushed

by academics and insurance companies trying to guarantee a painless, riskless way

to invest, sucking in more and more innocents. Index funds have been the

weapon of choice for big time selling annuity products for years. The

Journal article twists the petard a bit deeper, but does fairly point

out some of the changes that make stock pickers' job more tenuous.

One

of the reasons is correlation. In a shrinking environment contagion has

a better chance of flourishing. Part of it's owing to what Wall Street

is famous for, marketing, and a host of other reasons that include poor

corporate earnings, a low or almost no yield environment and that always

dirty five letter word, money. In today's topsy-turvey setting people

just want to get their money back rather than go for penthouse.

As

for signs this will change a Journal sidebar to the above story says it

all. In Palo Alto, California, according to one source, the average

home in the cheapest neighborhood is $1.3 million, pricing nearly all

middle class buyers out of the market. So the local planning commission

sought to address the problem only to discover one of their

commissioners reigned owing to the high cost of living. She and her

husband reportedly moved to Santa Cruz,California. And here another tidbit from the what goes around comes around past.

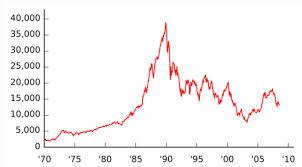

At the top of the Japanese stock market frenzy, the Emperor's Palace in

Tokyo was priced at a value greater than all the real estate in

California.

Tokyo's Surging Stock Prices Top Record Set Before October Crash

By SUSAN CHIRA, Special to the New York Times

Published: April 8, 1988

TOKYO, Friday, April 8—

Prices on the Tokyo stock market continued today to

rise above the peak reached before last fall's global market collapse.

No other major stock market has returned to its pre-crash levels.

Yesterday, the Nikkei average of 225 stocks closed

at 26,769.22 yen, well above the previous record of 26,646.43 yen

reached on Oct. 14, five days before share prices around the world

collapsed. That increase was 258.05 yen, or 97-hundredths of 1 percent.

In trading today the Nikkei had risen another 141.68 yen, to 26,910.90,

by the close of the morning session.

The surge in prices demonstrates the underlying

strength in the Tokyo Stock Exchange, the world's largest in terms of

money invested. While the Tokyo market has now exceeded pre-crash

levels, the New York and London markets have posted comparatively modest

advances and are well below their record levels. [ In a move to

bolster investor confidence in the market, the New York Stock Exchange

proposed a sharp increase in the level of capital required for

specialist brokers to buy or sell stocks. Page D1. ] High corporate

profits, low interest rates, continuing economic growth, and Government

actions to prevent any drastic fall in stock prices have driven the

Tokyo market's rebound, analysts here said. Fears of Overheating.

Some Japanese officials, notably Satoshi Sumita,

governor of the Bank of Japan, have expressed fears that the Tokyo

market could be overheating. Mr. Sumita told reporters yesterday that

share prices were rising too fast in relation to the rate of economic

growth. Other analysts point out that any panic in other

stock markets might spread to Tokyo, given the degree to which markets

are interconnected. But most analysts here said they saw no signs of

imminent danger. Indeed, they said, the stock market's recent strength

rests on a firmer foundation than the surge that ended last October,

prompting most to predict that the market will continue to do well.

The market's rise reflects a recognition by the

Japanese of their nation's financial and industrial power, most analysts

agree. Pressed by trading partners to export less, Japanese companies

endured nearly two years of falling profits caused by the rise of the

yen against the dollar. But now demand from within Japan, not exports,

is driving Japanese economic growth.

''There is a feeling of great confidence that Japan

is now a master of its own fate economically,'' said Ron Napier, an

economist for Salomon Brothers Inc. here. ''Where people used to think

that they had to wait to ride the next export wave, now Japan can create

its own growth.''

Japanese stock prices have been recovering steadily

since the beginning of this year, and the breaking of the record had

been widely anticipated. Security analysts here said that Wednesday's

strong showing on Wall Street, when the Dow Jones industrial average

rose 64 points, or 3.2 percent, helped create yesterday's surge in

Tokyo. The Dow gained only a half-point yesterday. In Tokyo institutional investors, who have remained

cautious recently, bought heavily yesterday, and trading volume soared.

But analysts said there are other, more fundamental reasons for the

market's strength.

Corporate profits have rebounded sharply, by about

15 percent, since October. Japan's economy has continued to expand, with

domestic demand stimulating the growth. Interest rates have remained

low, making the potential for profit in the stock market seem more

appealing than keeping money in bank accounts. Last week, the Government imposed a 20 percent tax

on certain savings accounts that had been allowed to accumulate interest

tax free. Depositors are expected to shop around for better

investments, and some analysts have predicted their money would bolster

the stock markets. But such activity was not credited with any of this

week's advance. The market has benefited from the strong yen, which has

made imports of raw materials less expensive, helping to hold down

inflation despite rapid economic growth. Finally, the exchange rate

between the dollar and the yen, despite some recent fluctuations, seems

to be relatively stable.

''Japan is in a virtuous circle,'' said Peter

Tasker, general manager of research for Kleinwort Benson International, a

British securities firm. ''It's very difficult for things to go wrong

now, it seems.''

Mr. Tasker pointed out that share prices had climbed

gradually and steadily, in contrast to the sharp rises of last spring

and fall, when prices often jumped by 700 or 800 points. Still another factor is that success breeds success.

Susumu Kato, chief economist here for County Natwest, a British

financial institution, said that because the Tokyo market outperformed

other markets, fund managers around the world felt they could not afford

to stay out of Tokyo. Since mid-January, foreigners have returned to

the Tokyo market in force.

For months before the October collapse, some

analysts had speculated that any global crash might start in Tokyo. They

distrusted what appeared to be excessively high price-earnings ratios, a

common way to assess a stock's underlying value. But accounting rules

in Japan differ from those elsewhere, and Japanese investors tend to use

other measures, such as the worth of a company's land holdings, to

evaluate a stock. Foreigners may also have underestimated the

Government's commitment to keeping share prices high. Since the crash in

October, the Ministry of Finance has repeatedly moved to reassure

investors