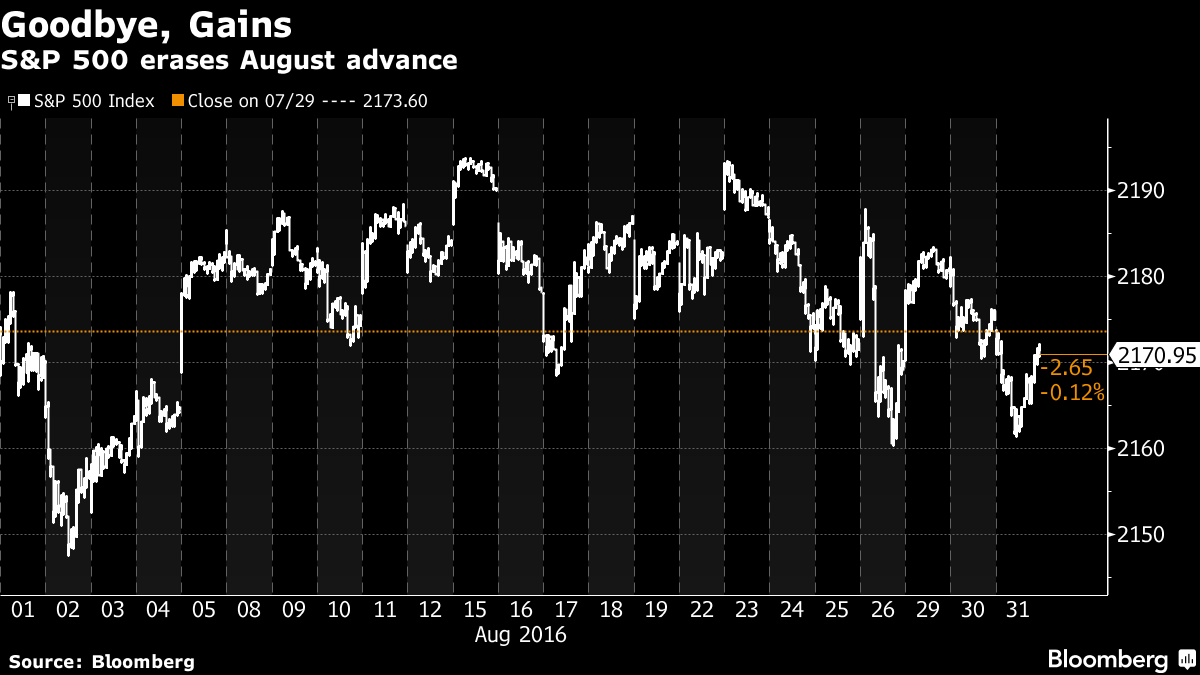

The stock market wilted a bit on the last day of the month on Wall Street Wednesday wiping out much of the gains of August as the last month of summer came to an end.

Bloomberg reported: The S&P 500 fell 0.2 percent to 2,170.95 as of 4 p.m. in New York. After posting five straight monthly gains and reaching a record Aug. 15, the U.S. benchmark has failed to maintain its momentum amid mixed economic data and uncertainty over the timing of the Fed’s next move. Meanwhile, the CBOE Volatility Index rallied 13 percent in August

Futures on Asian equity indexes mostly signaled declines, with contracts on gauges in Sydney, Seoul and Hong Kong down at least 0.4 percent in most recent trading. Nikkei 225 Stock Average futures added 0.1 percent to 16,900 in Osaka, and gained 0.3 percent to 16,910 on the Chicago Mercantile Exchange amid a sixth day of losses for the yen.

Energy companies trimmed their August advance to 0.6 percent, while utility stocks posted their biggest monthly decline in more than a year. Phone companies had their worst month since 2014 as technology and financial shares both rose for a second month.

European stocks fell 0.4 percent as declines in commodity and energy producers outweighed the best month for banks in more than a year. Commerzbank AG and Deutsche Bank AG rallied after Manager Magazin reported the latter was considering a potential merger. Greek lenders pushed the ASE Index to the best performance among western-European markets after Piraeus Bank SA and Alpha Bank AE released earnings.

The MSCI Emerging Markets Index trimmed its third consecutive monthly gain on Wednesday as declining commodity prices weighed on benchmark gauges in raw material-dependent nations from Russia to South Africa and Brazil.

We expect Asia to show similar results when we check overnight trading.

No comments:

Post a Comment