Apparently, the left hand and the right hand at Morgan Stanley are not in sync. We recently noted a WSJ Opinion article, "The Dollar--the Fed--Still Rule," by Morgan Stanley global strategist Ruchir Sharma who claimed the dollar's demise had been greatly overstated and the economy is all right.

See financialspuds.blogspot.com/2016/07/the-only-thing-new.

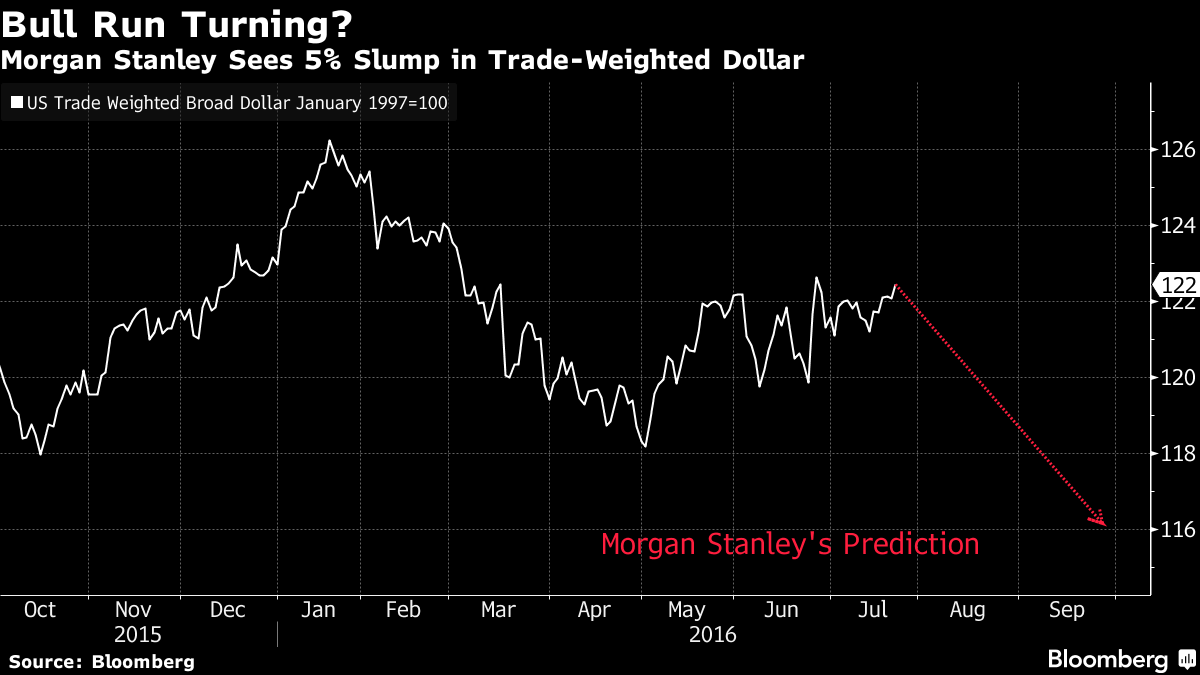

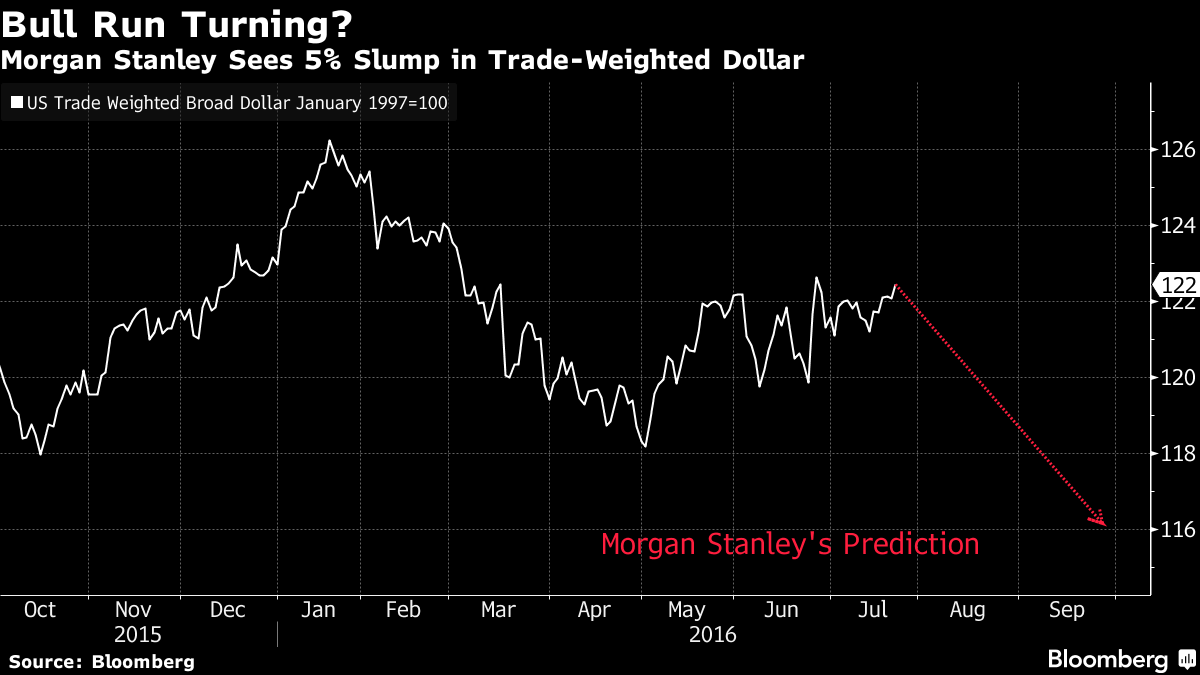

The dollar is set to fall 5 percent in the next few months, the Federal Reserve isn’t raising interest rates anytime soon and U.S. economic data is only going to get worse. That’s what Morgan Stanley chief global currency strategist Hans Redeker told clients in a note published Thursday, citing in-house indicators showing U.S. domestic demand is set to fade in the coming months. It didn’t take long for markets to prove him prescient. The greenback fell 1.3 percent Friday, capping its worst week since April, after the Commerce Department said U.S. second-quarter gross domestic product advanced at about half the rate economists had forecast.

See financialspuds.blogspot.com/2016/07/the-only-thing-new.

The dollar is set to fall 5 percent in the next few months, the Federal Reserve isn’t raising interest rates anytime soon and U.S. economic data is only going to get worse. That’s what Morgan Stanley chief global currency strategist Hans Redeker told clients in a note published Thursday, citing in-house indicators showing U.S. domestic demand is set to fade in the coming months. It didn’t take long for markets to prove him prescient. The greenback fell 1.3 percent Friday, capping its worst week since April, after the Commerce Department said U.S. second-quarter gross domestic product advanced at about half the rate economists had forecast.

www.wsj.com/articles/the-dollar and-the-fedstill-rule

“We are quite pessimistic about, first, the outcome of the U.S. economy,” Redeker said in an interview on Bloomberg Television Friday, before the GDP report’s release. “When you look at our internal indicators, which capture domestic demand very well, they are suggesting that the demand strength is going to fade from here.”

The greenback had rallied in recent weeks on mounting speculation the Fed will hike rates in the coming months following better-than-expected data on jobs, retail sales and industrial production. Dollar bulls’ hopes were dampened Wednesday after a lukewarm policy statement from Fed officials that signaled only a gradual pace towards tighter monetary policy. They were dashed after Friday’s GDP print, which showed a 1.2 percent annualized increase in the April-June period, less than the 2.5 percent median forecast of economists surveyed by Bloomberg.

Derivatives traders are now betting there’s only about a 1-in-3 chance of a rate hike this year, down from more than 50 percent at the beginning of the week. July data on payrolls and manufacturing, set for release next week, will give investors a clearer read on the path of Fed policy through the end of the year.

Further dollar strength will be limited as policy divergence between the U.S., Japan and Europe slows, according to Steven Englander, global head of Group-of-10 currency strategy at Citigroup Inc.

bloomberg.com/news/articles/2016-07-30/morgan-stanley-warns-currency-traders-worst-to-come-for-dollar

As we said in our post cited above, Sharma's article was about dismantling Trump not really about the dollar or the Fed except to keep up the charade about the importance of the Fed and it's role for keeping the status quo of globalization going.

“We are quite pessimistic about, first, the outcome of the U.S. economy,” Redeker said in an interview on Bloomberg Television Friday, before the GDP report’s release. “When you look at our internal indicators, which capture domestic demand very well, they are suggesting that the demand strength is going to fade from here.”

The greenback had rallied in recent weeks on mounting speculation the Fed will hike rates in the coming months following better-than-expected data on jobs, retail sales and industrial production. Dollar bulls’ hopes were dampened Wednesday after a lukewarm policy statement from Fed officials that signaled only a gradual pace towards tighter monetary policy. They were dashed after Friday’s GDP print, which showed a 1.2 percent annualized increase in the April-June period, less than the 2.5 percent median forecast of economists surveyed by Bloomberg.

Derivatives traders are now betting there’s only about a 1-in-3 chance of a rate hike this year, down from more than 50 percent at the beginning of the week. July data on payrolls and manufacturing, set for release next week, will give investors a clearer read on the path of Fed policy through the end of the year.

Further dollar strength will be limited as policy divergence between the U.S., Japan and Europe slows, according to Steven Englander, global head of Group-of-10 currency strategy at Citigroup Inc.

bloomberg.com/news/articles/2016-07-30/morgan-stanley-warns-currency-traders-worst-to-come-for-dollar

As we said in our post cited above, Sharma's article was about dismantling Trump not really about the dollar or the Fed except to keep up the charade about the importance of the Fed and it's role for keeping the status quo of globalization going.

No comments:

Post a Comment